The Process Of Selling Your Insurance

Did you know you could sell your insurance policies?

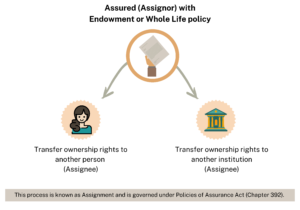

Certain situations that arises unexpectedly that may need you to cash out earlier than expected. Alternatively is that you may have reach breakeven point hence you wish to discontinue your policy. In general, life policies and endowments or savings policies can be sold, via a process called absolute assignment. Absolute assignment is a transfer of ownership on a particular policy, however the life assured remains.

Photo Credit: REPs Invest

One may asked if you can still “sell” your policy should you miss out on premiums. This would largely depends on the amount of defaulted payments and if the policy is still inforced or has already lapsed. Most of the time when your policy has enough cash value, the policy will run on automatic premium loan and it is still assignable.

The advantage of assigning it to another party is that you are able to get a higher value than the insurer’s given surrender value. However, do note that the new policyowner will benefit from the insured’s death.

How to go about selling?

1. Find a reputable and trustworthy third party vendor

2. Get a valuation to see how much is your policy worth

3. Take some time to review the offer

4. Transfer of policy

5. Payment

- There are a few companies out there doing this so you may do your due diligence in finding one that is to your liking, eg. Reps Holdings

- Reps Holdings will need some basic information to valuate your policy. Details such as policy name, start date, end date (for endowments), premium term and amount and also the current surrender value. More information will be needed accordingly as per policy requirements.

- Reps Holdings usually get back within 24 hours with a quote.

- Should you accept the given quote, a representative will meet you to sign the relevant documents and the insurer will take about 7-14 days to transfer the policy over to Reps.

- Reps do payment via a cheque or paynow.